As Comparing Home and Auto Insurance Bundles: Are They Worth It? takes center stage, this opening passage beckons readers with a crafted world of good knowledge, ensuring an absorbing and original reading experience.

In the following paragraph, you will find descriptive and clear information about the topic.

Understanding Home and Auto Insurance Bundles

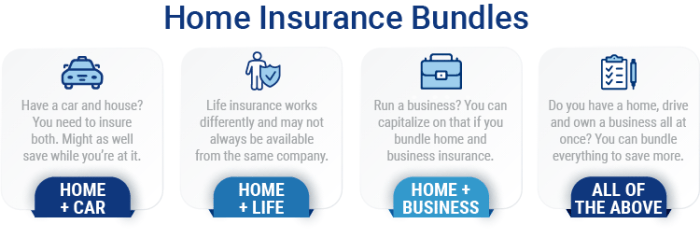

When it comes to insurance, bundling your home and auto policies together can offer a range of benefits for policyholders. This strategy involves purchasing both types of insurance from the same provider, often resulting in cost savings and added convenience.

Concept of Bundling Home and Auto Insurance

Bundling home and auto insurance simply means buying both policies from the same insurance company. This allows you to combine your coverage under one provider, streamlining the process of managing your insurance needs.

Benefits of Bundling

- Potential Cost Savings: Insurance companies often offer discounts to customers who bundle their home and auto policies. This can result in lower premiums compared to purchasing separate policies.

- Convenience: Managing both policies with one insurer can simplify payments, claims, and communication. You'll have a single point of contact for all your insurance needs.

- Enhanced Coverage Options: Some insurers offer additional benefits or coverage enhancements for policyholders who bundle their home and auto insurance.

Insurance Companies with Bundled Packages

Some well-known insurance companies that offer bundled packages include:

- State Farm

- Allstate

- Progressive

- GEICO

Coverage and Cost Considerations

When comparing standalone home and auto insurance to bundled policies, it is essential to consider the coverage options and potential cost savings. Bundling insurance policies may seem like a convenient and cost-effective option, but it's crucial to understand the limitations and drawbacks before making a decision.

Coverage Options

- Standalone Home Insurance: Standalone home insurance typically provides coverage for your property's structure, personal belongings, liability protection, and additional living expenses in case of a covered loss.

- Standalone Auto Insurance: Standalone auto insurance covers damages to your vehicle, liability protection, medical expenses, and uninsured/underinsured motorist coverage.

- Bundled Home and Auto Insurance: Bundled policies combine the coverage options of standalone home and auto insurance into one package, offering convenience and potentially additional benefits like discounts.

Cost Savings

- Discounts: Insurance companies often provide discounts when you bundle home and auto insurance policies with them. These discounts can help lower your overall insurance costs.

- Single Deductible: Bundled policies may also come with a single deductible for both home and auto claims, which can save you money in the event of a covered loss.

- Policy Management: Managing one bundled policy is simpler and more convenient than dealing with multiple standalone policies, potentially saving you time and effort.

Limitations and Drawbacks

- Less Flexibility: Bundled policies may limit your ability to customize coverage options for your home or auto insurance, as they are packaged together.

- Higher Premiums: In some cases, bundling home and auto insurance may result in higher premiums compared to purchasing standalone policies separately. It's essential to compare quotes to ensure you're getting the best deal.

- Dependency on a Single Provider: Opting for bundled insurance means you are dependent on a single insurance provider for both your home and auto coverage, which may limit your options in the future.

Evaluating Insurance Providers

When it comes to choosing the right insurance provider for bundled policies, there are a few key factors to consider. From reputation and reliability to customer reviews and experiences, finding the best insurance company can make a significant difference in your coverage and overall satisfaction.

Researching Reputation and Reliability

Before committing to an insurance provider for your home and auto bundle, it's essential to research their reputation and reliability. Look for companies with a strong financial standing and a history of honoring claims promptly. Check customer reviews and ratings on independent websites to get a sense of their customer service and overall satisfaction levels.

Comparing Customer Reviews and Experiences

One of the best ways to gauge the quality of an insurance provider offering bundled packages is to read customer reviews and experiences. Look for feedback on how efficiently claims are processed, how responsive the customer service is, and whether the company offers competitive rates and discounts for bundled policies.

Real-life experiences from policyholders can give you valuable insights into what to expect.

Customization and Flexibility

When it comes to bundled home and auto insurance policies, one key factor to consider is the level of customization and flexibility they offer. These aspects can greatly impact the overall value and suitability of a bundled insurance package for individual needs and preferences.

Level of Customization

Bundled insurance policies typically allow for a certain degree of customization to tailor coverage to the specific needs of the policyholder. This can include adjusting coverage limits, adding or removing certain types of coverage, or selecting deductible amounts that align with personal preferences and budget constraints.

- Policyholders may have the option to choose different coverage levels for their home and auto insurance components within the bundle.

- Additional coverage options, such as personal property protection, roadside assistance, or identity theft coverage, can often be added to a bundled policy for enhanced protection.

- Customizing coverage based on factors like the value of assets, driving habits, or specific risks associated with the property can help ensure adequate protection.

Flexibility of Adjustments

In addition to customization, flexibility in making changes or adjustments to a bundled policy can be crucial. Life circumstances, asset values, and insurance needs can change over time, so having the ability to modify coverage seamlessly is essential.

- Policyholders may be able to make adjustments to their bundled policy, such as increasing or decreasing coverage limits, changing deductible amounts, or adding/removing specific coverage options.

- Flexibility in adjusting coverage can help policyholders adapt to changing needs without having to completely overhaul their insurance policies.

- Insurance providers may offer online portals or customer service options that make it easy to request changes to a bundled policy quickly and efficiently.

Last Word

Concluding with a engaging summary, the discussion on Comparing Home and Auto Insurance Bundles: Are They Worth It? leaves a lasting impression.

Key Questions Answered

Are there limitations to opting for bundled insurance policies?

While cost-effective, bundled policies may have limitations in terms of coverage flexibility compared to standalone policies. It's essential to carefully review the terms before making a decision.

How do I choose the right insurance provider for bundled policies?

When selecting an insurance provider for bundled policies, consider factors such as reputation, customer reviews, and the level of customization they offer. Researching and comparing multiple providers can help you make an informed choice.

Can I make changes to a bundled policy easily?

Most insurance companies allow some level of flexibility in making changes to bundled policies. However, it's advisable to check their policy on modifications and understand any associated fees or limitations.