Exploring the realm of Best Low-Cost Insurance Options for Small Businesses Worldwide, this paragraph sets the stage for a compelling journey, enticing readers with valuable insights and surprises along the way.

Providing a detailed overview of the topic, this paragraph delves into the key aspects and considerations surrounding low-cost insurance for small businesses globally.

Overview of Low-Cost Insurance Options

Low-cost insurance options for small businesses refer to affordable insurance policies designed to provide coverage and protection at a reasonable price point. These options are tailored to meet the specific needs of small businesses while keeping costs manageable.Having insurance coverage is crucial for small businesses as it helps protect against unexpected events that could lead to financial losses or even closure of the business.

Insurance provides a safety net by covering costs related to property damage, liability claims, employee injuries, and other risks that businesses may face.

Key Factors to Consider When Choosing Low-Cost Insurance Options

When selecting low-cost insurance options for your small business, it is essential to consider several key factors to ensure you are getting the coverage you need at a price you can afford. Some important factors to keep in mind include:

- Assessing your specific insurance needs based on the nature of your business and potential risks.

- Comparing quotes from different insurance providers to find the best rates and coverage options.

- Understanding the terms and conditions of the insurance policy, including coverage limits, deductibles, and exclusions.

- Checking the financial stability and reputation of the insurance company to ensure they can fulfill their obligations in case of a claim.

- Seeking recommendations from other small business owners or industry experts to find reliable insurance options.

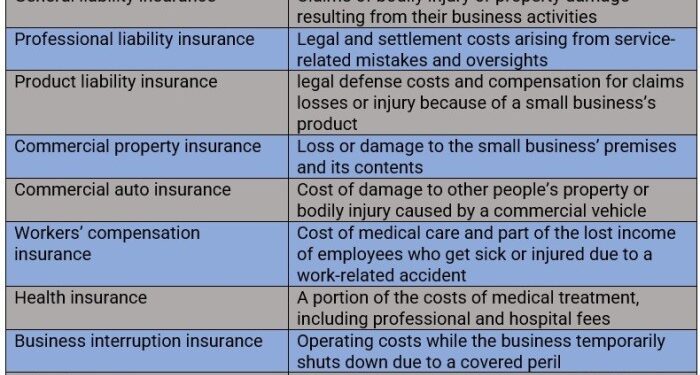

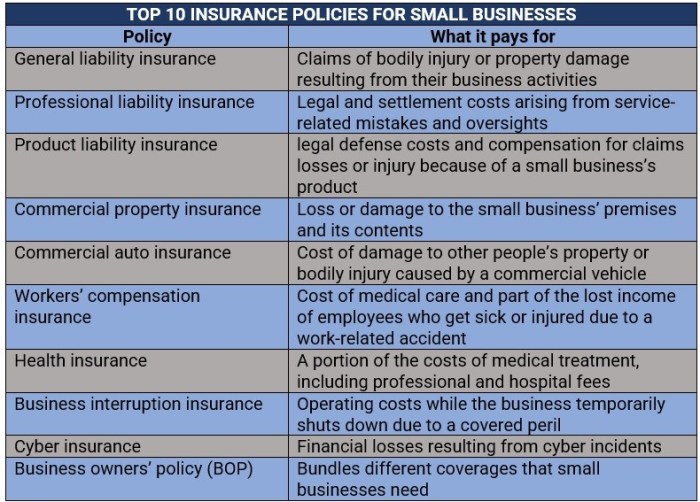

Types of Low-Cost Insurance Available

When it comes to protecting a small business, having the right insurance coverage is crucial. There are several types of low-cost insurance options available that can provide essential protection without breaking the bank.

General Liability Insurance

General liability insurance is a fundamental policy that covers legal costs and damages in case a business is sued for bodily injury, property damage, or advertising injury. It provides protection against claims of negligence, personal injury, and more. This type of insurance is essential for small businesses to safeguard their assets and reputation.

Property Insurance

Property insurance is another important coverage for small businesses, especially those that own or lease physical space. This policy protects against damage or loss of property due to fire, theft, vandalism, or other covered events. Property insurance can help businesses recover and rebuild in case of a disaster, ensuring continuity of operations.

Workers’ Compensation Insurance

Workers' compensation insurance is mandatory in most states and provides benefits to employees who suffer work-related injuries or illnesses. This coverage helps small businesses cover medical expenses, lost wages, and rehabilitation costs for employees injured on the job. Workers' compensation insurance not only protects employees but also shields employers from potential lawsuits related to workplace injuries.

Comparison of Low-Cost Insurance Providers

When it comes to choosing low-cost insurance options for small businesses worldwide, it's essential to compare and contrast different insurance providers to find the best fit for your specific needs. Let's take a closer look at some popular insurance companies offering affordable coverage.

XYZ Insurance Company

- Offers competitive rates for small businesses looking to minimize costs.

- Provides a range of coverage options, including general liability, property insurance, and worker's compensation.

- Known for excellent customer service and quick claims processing.

ABC Insurance Co.

- Specializes in tailored insurance solutions for small businesses of all types.

- Flexible payment options and customizable coverage plans to meet specific needs.

- Positive customer reviews highlighting responsive support and hassle-free claims process.

DEF Insurance Services

- Focuses on affordability without compromising on coverage quality.

- Offers innovative insurance products designed for small business owners on a budget.

- Reputable track record and high customer satisfaction ratings.

Tips for Finding Affordable Insurance

Finding affordable insurance for your small business is crucial to managing costs while still protecting your assets. Here are some strategies to help you find the best low-cost insurance options:

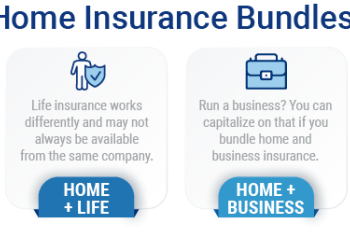

Bundling Insurance Policies

When looking for affordable insurance, consider bundling multiple policies together with the same insurance provider. By combining your general liability, property, and other insurance needs into a single package, you may be able to get a discount on your overall premium.

This can result in significant cost savings for your small business.

Negotiating with Insurance Providers

Don't be afraid to negotiate with insurance providers to get better rates. You can ask for discounts based on factors such as your business's claims history, safety measures in place, or industry affiliations. Be prepared to compare quotes from different providers and leverage these quotes to negotiate the best possible rate.

Remember, insurance premiums are not set in stone, and there is often room for negotiation.

Final Wrap-Up

Wrapping up our discussion on Best Low-Cost Insurance Options for Small Businesses Worldwide, this paragraph encapsulates the main points and leaves readers with a lasting impression.

Common Queries

What factors should small businesses consider when choosing low-cost insurance?

Small businesses should consider factors such as coverage limits, premiums, deductibles, and specific industry risks when selecting low-cost insurance options.

How can bundling insurance policies help small businesses reduce costs?

Bundling insurance policies from the same provider can often lead to discounts and lower overall premiums, providing cost-saving benefits for small businesses.

Why is workers' compensation insurance important for small businesses?

Workers' compensation insurance is crucial for small businesses as it provides coverage for employees' medical expenses and lost wages in case of work-related injuries or illnesses.