Exploring the debate between Cigna and other providers, this introduction sets the stage for a detailed comparison of commercial health insurance plans. It aims to inform readers about the key aspects to consider when selecting the right plan for their needs.

The following paragraphs will delve deeper into the features, costs, and customer feedback of Cigna and other major providers, offering a comprehensive analysis to help you make an informed decision.

Introduction to Commercial Plans

Commercial health insurance refers to health coverage provided by private companies, as opposed to government-sponsored plans like Medicare or Medicaid. These plans are designed for individuals and businesses looking for customized healthcare options.

Choosing the right commercial plan is crucial for both individuals and businesses to ensure they have access to the healthcare services they need at a cost that fits their budget. Factors such as coverage options, network of providers, premiums, and out-of-pocket costs should be carefully considered when comparing commercial plans.

Key Factors to Consider When Comparing Commercial Plans

- Coverage Options: Evaluate what services and treatments are included in the plan, such as doctor visits, prescriptions, and preventive care.

- Network of Providers: Check if your preferred doctors and hospitals are in-network to avoid higher out-of-pocket costs.

- Premiums and Deductibles: Compare monthly premiums and annual deductibles to find a plan that balances cost and coverage.

- Out-of-Pocket Costs: Consider co-pays, co-insurance, and maximum out-of-pocket limits to understand your financial responsibility.

Cigna Commercial Plan

Cigna offers a range of commercial health insurance plans designed to meet the diverse needs of businesses and their employees. These plans come with various features and benefits that make them a popular choice for many individuals and organizations looking for quality healthcare coverage.

Features and Benefits

- Comprehensive coverage for medical services, including doctor visits, hospital stays, prescription drugs, and more.

- Access to a wide network of healthcare providers, ensuring you can receive care from trusted professionals.

- Wellness programs and resources to help you maintain a healthy lifestyle and prevent illness.

- 24/7 customer service support to assist with any questions or concerns related to your plan.

Network Coverage

Cigna's commercial health insurance plans provide access to a vast network of healthcare providers, including hospitals, doctors, specialists, and pharmacies. This extensive network ensures that you can receive quality care from a wide range of professionals, giving you peace of mind regarding your healthcare needs.

Enrollment Process and Eligibility

- Employers can choose to offer Cigna's commercial plans to their employees as part of their benefits package.

- Individuals may also be eligible to enroll in Cigna plans through the Health Insurance Marketplace or directly through Cigna's website.

- Eligibility requirements may vary depending on the specific plan and employer offerings, so it's essential to check with Cigna or your employer for more information.

Other Providers Comparison

When considering commercial health insurance providers, it is essential to compare the features, benefits, and network coverage offered by each. Let's explore how Cigna stacks up against other major providers in the market.

Major Commercial Health Insurance Providers

- UnitedHealthcare: One of the largest health insurance providers in the US, offering a wide range of plans and comprehensive coverage options.

- Anthem Blue Cross Blue Shield: Known for its extensive network of healthcare providers and various plan choices to suit different needs.

- Aetna: Offers innovative health and wellness programs along with a vast network of healthcare professionals.

Comparison with Other Providers

- Cigna vs. UnitedHealthcare: While Cigna is praised for its focus on preventive care and wellness programs, UnitedHealthcare's sheer size and global reach provide a wider network of providers.

- Cigna vs. Anthem Blue Cross Blue Shield: Cigna's emphasis on personalized customer service may stand out compared to Anthem's reputation for high-quality coverage and member satisfaction.

- Cigna vs. Aetna: Aetna's innovative health initiatives and comprehensive plan options might appeal to those looking for a more holistic approach to healthcare compared to Cigna's more traditional offerings.

Unique Offerings of Other Providers

- UnitedHealthcare's focus on digital health solutions and telemedicine services sets it apart in the market.

- Anthem Blue Cross Blue Shield's commitment to community health programs and wellness initiatives gives it a unique edge in promoting overall well-being.

- Aetna's collaboration with CVS Health allows for integrated care solutions and convenient access to medications and healthcare services.

Cost Analysis

In this section, we will delve into the cost structure of Cigna's commercial plans and compare them with other providers to determine the cost-effectiveness of these plans.

Cigna’s Cost Structure

- Cigna offers a range of commercial plans with varying premiums based on coverage and benefits.

- The deductibles with Cigna plans may differ depending on the plan type and coverage options selected.

- Out-of-pocket expenses, such as copayments and coinsurance, can also vary with Cigna commercial plans.

Comparison with Other Providers

- When comparing premiums, deductibles, and out-of-pocket expenses, Cigna's commercial plans may be competitive with other providers in the market.

- It is essential to consider the overall value and coverage provided by Cigna and other providers to determine the cost-effectiveness of the plans.

Factors Influencing Cost-Effectiveness

- Network coverage and provider networks can influence the cost of commercial plans, as in-network services may be more cost-effective.

- Plan benefits, such as prescription drug coverage and preventive care, can impact the overall cost and value of a commercial plan.

- The individual's health needs and usage of medical services can also play a role in determining the cost-effectiveness of a commercial plan.

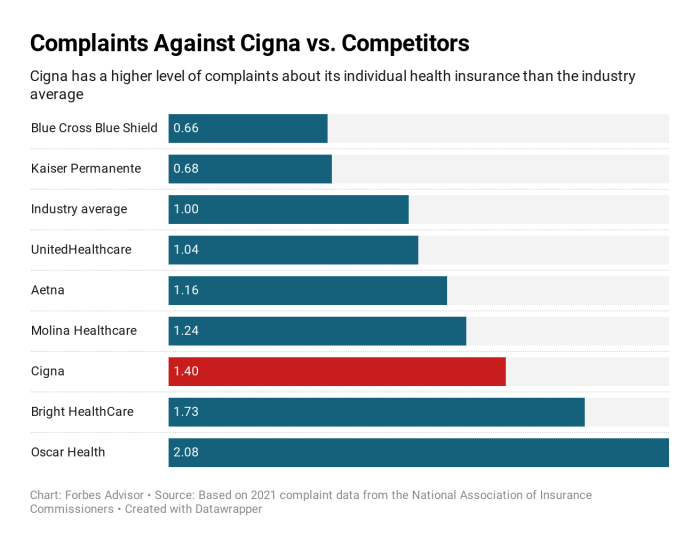

Customer Satisfaction and Reviews

When it comes to choosing a commercial plan, customer satisfaction and reviews play a crucial role in making an informed decision. Let's dive into the feedback and experiences of customers with Cigna's commercial plans compared to other providers.

Cigna Customer Satisfaction

- Cigna has received positive feedback from customers for their comprehensive coverage and excellent customer service.

- Many customers appreciate the ease of access to healthcare providers within Cigna's network.

- Some customers have reported quick claims processing and reimbursement, adding to their overall satisfaction with Cigna.

Other Providers Comparison

- Feedback for other providers varies, with some customers expressing frustrations with limited coverage options or difficulty in finding in-network providers.

- Long waiting times for claims processing and lack of transparency in billing have been common complaints among customers of other providers.

- Overall, customer satisfaction levels with other providers seem to fluctuate more compared to Cigna.

Significance of Customer Feedback

Customer feedback serves as a valuable source of information for individuals looking to select the best commercial plan for their needs. By considering the experiences shared by other customers, individuals can gain insights into the quality of service, coverage options, and overall satisfaction levels offered by different providers.

Making an informed decision based on customer feedback can help individuals choose a commercial plan that aligns with their healthcare needs and preferences.

Final Wrap-Up

In conclusion, weighing the pros and cons of Cigna and other providers is crucial in determining the most suitable commercial plan. By considering factors like coverage, costs, and customer satisfaction, individuals and businesses can make an educated choice that aligns with their healthcare needs.

Query Resolution

What are the key factors to consider when comparing commercial plans?

Key factors include coverage options, costs, network availability, and customer reviews.

How does Cigna's network coverage compare to other providers?

Cigna offers a wide network of healthcare providers, but the extent of coverage may vary depending on the region.

What unique advantages do other providers have over Cigna?

Other providers may offer specialized services or better pricing options compared to Cigna.