Top Bundle Insurance Quotes for Families in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve into the evolving trends, cost analysis, coverage comparison, and technology integration of family insurance bundles, we uncover a landscape that is both dynamic and promising for families in 2025.

Research Trends in Family Insurance Bundles

Family insurance bundles in 2025 are expected to undergo significant changes to adapt to evolving consumer needs and market trends. These changes will impact coverage, pricing, and benefits offered by insurance companies.

Evolving Trends in Family Insurance Bundles

Family insurance bundles are likely to become more personalized and flexible in 2025. Insurance companies may offer customizable packages that cater to specific family needs, such as health, home, auto, and life insurance all bundled together for convenience and cost savings.

- Insurance companies are expected to leverage technology to streamline the process of purchasing and managing family insurance bundles. This could include the use of mobile apps for claims processing, policy updates, and customer support.

- Increased focus on digitalization and virtual services may lead to enhanced customer experiences, with 24/7 access to insurance information and support.

- With the rise of the gig economy and remote work, insurance companies may introduce new coverage options tailored to freelancers and remote workers who may have different insurance needs compared to traditional families.

Top Insurance Companies Offering Family Bundles

Several insurance companies stand out in the market for their family insurance bundles, each with unique selling points that cater to different consumer segments.

For example, Company A may focus on providing comprehensive health and wellness benefits for families, while Company B may emphasize competitive pricing and discounts for bundled policies.

- Company A: Known for its extensive network of healthcare providers and personalized wellness programs included in their family insurance bundles.

- Company B: Offers a wide range of insurance products bundled together at discounted rates, appealing to budget-conscious families.

- Company C: Stands out for its innovative use of AI technology to assess risks and tailor coverage options to meet the unique needs of each family.

Innovative Features in Family Insurance Bundles

In 2025, family insurance bundles may introduce innovative features to enhance coverage and provide added value to policyholders.

- Smart home integration: Insurance companies could partner with smart home device manufacturers to offer discounts on home insurance premiums for families with connected devices that improve home security and safety.

- Virtual healthcare services: Family insurance bundles may include access to telemedicine services for remote consultations with healthcare providers, reducing the need for in-person visits and enhancing convenience.

- Cybersecurity protection: With the increasing threat of cyberattacks, insurance companies may add cybersecurity coverage to family bundles to protect against identity theft, data breaches, and other online risks.

Cost Analysis of Top Bundle Insurance Quotes

When it comes to selecting insurance for your family, understanding the cost implications of different bundled insurance quotes is crucial. Let's delve into the factors influencing pricing and compare the cost-effectiveness of bundled insurance policies versus individual ones.

Variations in Cost Among Different Providers

Insurance providers determine the cost of family insurance bundles based on various factors such as the number of family members, their ages, health conditions, location, and coverage limits. Different providers may offer varying premiums based on their risk assessment models and underwriting criteria.

Factors Influencing Pricing of Family Insurance Bundles

- Family Composition: The number of family members and their ages can impact the overall cost of insurance bundles.

- Health History: Pre-existing conditions or family medical history can influence the pricing of insurance policies.

- Location: The geographical area where the family resides can affect insurance rates due to varying risks.

- Coverage Limits: Higher coverage limits may lead to increased premiums but offer more comprehensive protection.

Cost-Effectiveness of Bundled Insurance Policies

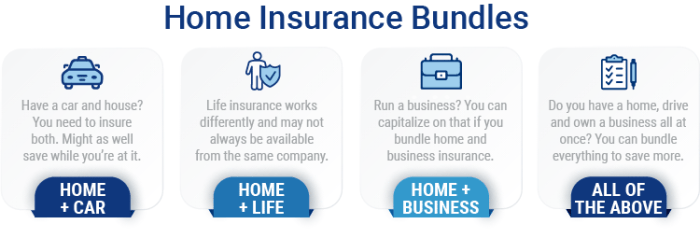

Opting for a bundled insurance policy for your family can often be more cost-effective than purchasing individual policies for each family member. Bundling can lead to discounts and savings on premiums, making it a more affordable option for comprehensive coverage.

Strategies to Reduce Insurance Costs for Families

- Bundle Policies: Consolidating all family members' insurance needs under one policy can lead to cost savings.

- Review Coverage Regularly: Assess your family's insurance needs periodically to ensure you are not overpaying for unnecessary coverage.

- Consider Deductibles: Choosing higher deductibles can lower premiums but make sure you can afford the out-of-pocket costs in case of a claim.

- Shop Around: Compare quotes from multiple insurance providers to find the best value for your family's coverage needs.

Coverage Comparison of Top Bundle Insurance Quotes

In family insurance bundles, various types of insurance coverage are commonly included to provide comprehensive protection for families in 2025. Let's explore the coverage limits, exclusions, customizable options, and how families can ensure they have adequate coverage for different aspects of their lives

Types of Insurance Coverage in Family Insurance Bundles

- Health Insurance: Covers medical expenses for illness or injury.

- Life Insurance: Provides financial protection in case of death.

- Homeowners/Renters Insurance: Protects the home and personal belongings.

- Auto Insurance: Covers damage or loss related to vehicles.

- Disability Insurance: Offers income protection in case of disability.

Comparison of Coverage Limits and Exclusions among Top Providers

| Insurance Provider | Coverage Limits | Exclusions |

|---|---|---|

| Provider A | High coverage limits for health and life insurance. | Excludes pre-existing conditions in health insurance. |

| Provider B | Comprehensive coverage for home and auto insurance. | Excludes coverage for certain high-risk activities. |

Importance of Customizable Coverage Options for Families

Customizable coverage options allow families to tailor their insurance policies to meet their specific needs and budget constraints.

Ensuring Adequate Coverage for Families

- Regularly review and update insurance policies to reflect changes in family circumstances.

- Consult with insurance agents to understand coverage options and ensure all aspects of family life are adequately protected.

- Consider bundling multiple insurance policies with the same provider to potentially save on premiums.

Technology Integration in Family Insurance Bundles

Technology plays a crucial role in shaping the landscape of family insurance bundles. From AI to IoT and data analytics, advancements in technology are revolutionizing the way insurance products are offered and managed. Let's delve into how these technological innovations are impacting family insurance bundles.

Benefits of Technology-Driven Insurance Products for Families

- Improved Efficiency: AI and data analytics can streamline processes, making it easier for families to manage their policies and claims.

- Personalized Offerings: Technology allows for more personalized insurance solutions tailored to the unique needs of each family member.

- Enhanced Security: IoT devices can help prevent losses and mitigate risks by providing real-time monitoring and alerts.

Potential Drawbacks of Technology-Driven Insurance Products for Families

- Privacy Concerns: The use of data analytics may raise privacy issues regarding the collection and use of personal information.

- Dependency on Technology: Families may become overly reliant on technology, leading to potential disruptions in case of system failures.

- Cost: The initial investment in technology integration may result in higher premiums for families.

Enhancing Customer Experience in Managing Insurance Policies

- Mobile Apps: Insurance companies are developing user-friendly mobile apps that allow families to access policy information and make claims on the go.

- Online Portals: Web-based portals provide a convenient platform for families to manage their policies, make payments, and track claims.

- Virtual Assistants: AI-powered virtual assistants can provide instant support and guidance to families regarding their insurance queries.

Innovative Tech Solutions Reshaping the Family Insurance Landscape

- Telematics Devices: Usage-based insurance policies that utilize telematics devices to track driving behavior and offer discounts based on safe driving habits.

- Blockchain Technology: Implementing blockchain for secure and transparent transactions in insurance claims processing.

- Predictive Analytics: Utilizing predictive analytics to assess risks and customize insurance solutions for families based on data insights.

Last Point

In conclusion, Top Bundle Insurance Quotes for Families in 2025 not only provides a roadmap for families seeking optimal coverage but also highlights the innovations and strategies that will shape the insurance industry in the years to come. Stay informed, stay covered, and embrace the future of family insurance with confidence.

Essential FAQs

What factors can influence the pricing of family insurance bundles?

Factors such as the family's location, members' ages, health history, coverage limits, and chosen deductible can all impact the pricing of family insurance bundles.

Are there any notable benefits of technology-driven insurance products for families?

Technology-driven insurance products can offer improved efficiency, personalized experiences, easier claims processing, and enhanced security for families. However, potential drawbacks may include data privacy concerns and reliance on technology for customer service.

How can families ensure they have adequate coverage in 2025?

Families can ensure adequate coverage by regularly reviewing their policies, understanding their needs, staying informed about industry trends, and working with insurance providers to customize their coverage based on changing circumstances.